This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Business is booming — keep it that way.

Easthigh Credit Union knows what it takes to keep established and growing businesses running smoothly. That’s why we offer 500 free transactions per month and large no‑charge currency or coin deposits for companies that need their banking to keep up.

- You have an established business.

- You have large transaction volumes.

- You want easy ways to maintain high cash flow.

Account Features

- 500 free transactions per month1

- Up to $25,000 cash or coin/currency deposits at no charge2

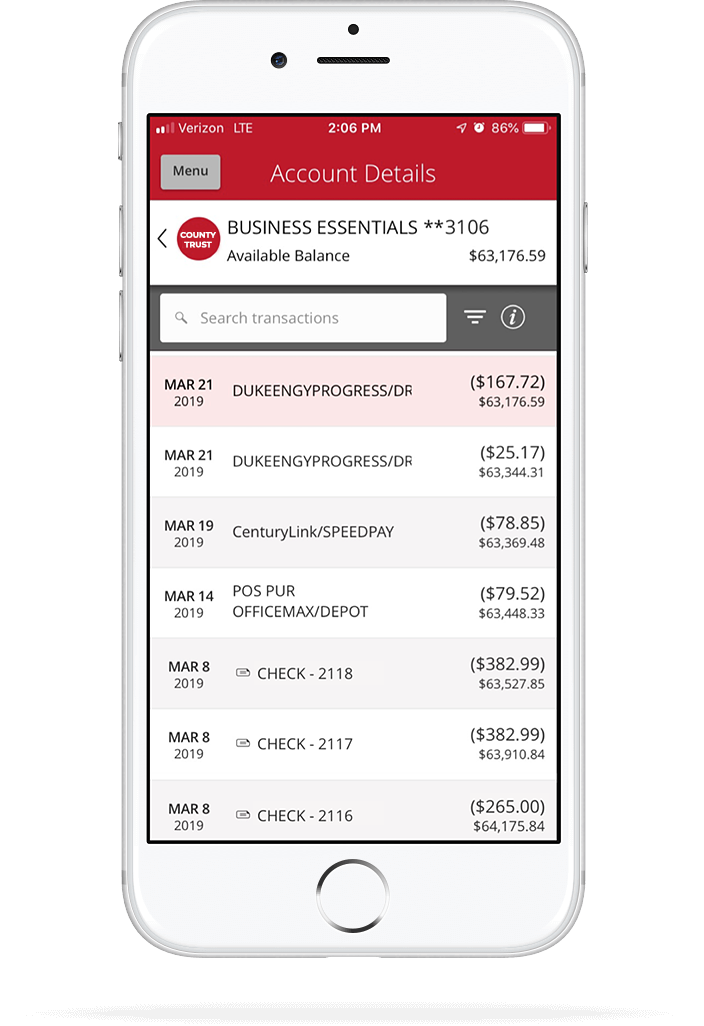

- Free digital banking3

- Free 24-hour telephone banking

- Free eStatements or paper statements

- Online bill pay

Account Fees

You can easily avoid the $25 maintenance fee by meeting the following requirement during the statement cycle4:

- Maintain a $3,000 minimum balance,or

- Maintain an average collected balance of $6,000,or

- Maintain a combined balance of $50,000 in personal or business deposits, or

- Maintain a combined balance of $50,000 or more in outstanding personal loan, HELOC, or business loan balances5

Account Benefits

Ready to get started?

You may be interested in…

- A transaction is defined as any checks paid, deposits, each deposited item, ATM withdrawals, debit card transactions, online and telephone funds transfers, and ACH debits and credits. There is a fee of $0.40 per item for each item in excess of 500 per statement cycle (or month).

- A fee of $0.18 per $100 on all additional cash deposits.

- While Easthigh Credit Union does not charge for mobile banking, your mobile carrier’s message and data rates may apply.

- Account holders may avoid the Monthly Maintenance Fee by meeting any of the requirements listed in the Keep if Fee Free™ section of the account summary table for their account type. Other account service fees may apply as described in the Account Services Fee Schedule, which is also available at your local branch.

- Eligible personal or business deposits include checking, savings, Money Market, CD or IRA. Eligible personal loans do not include residential mortgage loans.