This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Access features and services that make your bank one less thing to manage.

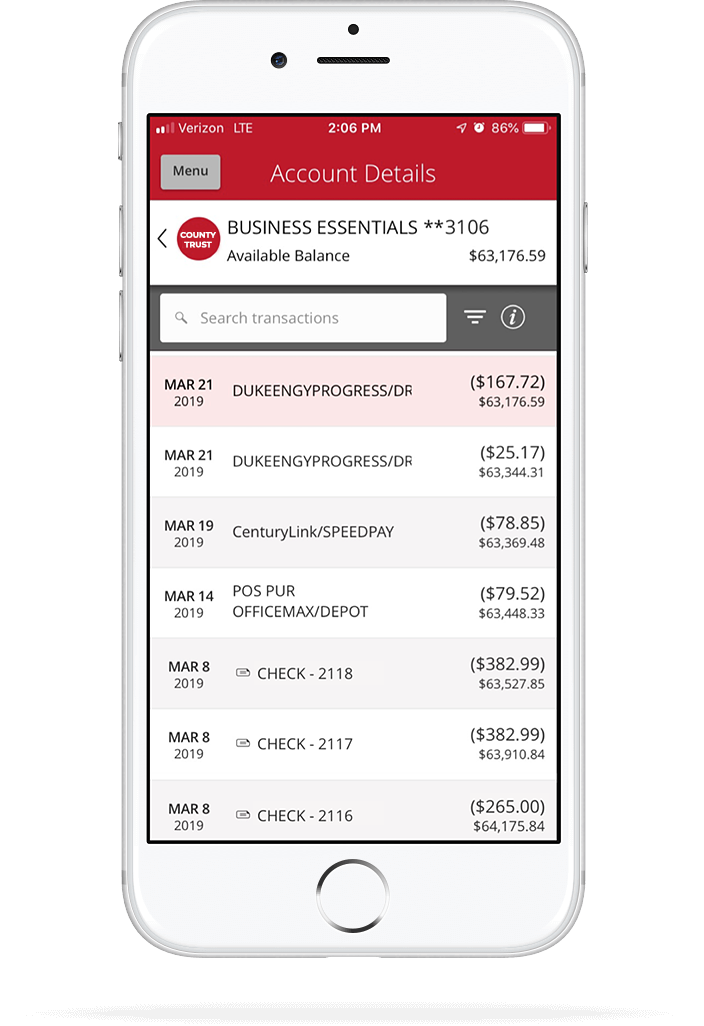

Specially designed for growing businesses with cash-flow tools, merchant services, and security features to protect your business.

- You own a small or mid-sized business.

- You want extra security protections.

- You currently use our Treasury Services or Business Credit Card.

Account Features

- 500 free transactions per month1

- Up to $25,000 cash or coin/currency deposits at no charge2

- Free first order of business Intropack checks

- Eligible for the Small Business Bundle personal checking account

- Eligible for premium mobile check deposit limits

- Enhanced access to Treasury Services, like payment solutions and credit card processing

- Small Business Monitoring & Identity Management Center3

- Data Breach Solutions3

- Up to $1,000,000 Identity Theft Expense Reimbursement Coverage4

- Cell Phone Protection4

Employee Benefits

- First@Work employee checking accounts

- Travel, leisure, dining, and lifestyle discounts at thousands of local and national retailers3

- Earn cash rewards when you shop online at dozens of your favorite retailers3

- Prescription savings on brand-name and generic drugs5

- Vision care savings on eyewear, exams, and surgical procedures5

- Dental savings on services like routine care, orthodontics, oral surgery, and more5

Account Fees

You can easily avoid the $25 maintenance fee by having one or more of the following products8:

- Merchant Services

- Autobooks

- Direct Deposit Payroll Services

- Active Business Credit Card9

Account Bonus

Get 15,000 reward points for new Mastercard® Business Card with Rewards Cardholders after $500+ in credit card purchases:6

- Open a Mastercard® Business Card with Rewards

- Activate your credit card and spend $500+ in purchases within 45 days7

Account Benefits

Ready to get started?

You may be interested in…

- A transaction is defined as any checks paid, deposits, each deposited item, ATM withdrawals, debit card transactions, online and telephone funds transfers, and ACH debits and credits. There is a fee of $0.40 per item for each item in excess of 500 per statement cycle (or month).

- A fee of $0.18 per $100 on all additional cash deposits.

- Benefits require registration/activation.

- Cell phone protection is only available when the cell phone bill is paid from your First@Work checking account. Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions, and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is offered through the company named in the Guide to Benefit or on the insurance document. Insurance Products are not insured by the FDIC or any Federal Government Agency; not a deposit of or guaranteed by the bank or any bank affiliate. Expense reimbursement does not cover unauthorized electronic transfers related to the business.

- This is NOT insurance.

- Credit cards are subject to credit approval. To receive 15,000 (a $150 value) Easthigh Credit Union rewards points, card owners must open and activate a Mastercard® Business Card with Rewards, and spend $500 or more within 45 days of opening. Bonus rewards points awarded through this promotion will be credited to your account within 60 business days of qualifying for the bonus. To access your bonus points, visit the Easthigh Credit Union One Rewards program through online or mobile banking. This offer is for new cardholders only.

- Account holders may avoid the Monthly Maintenance Fee by meeting any of the requirements listed in the Keep it Fee Free™ section of the account summary table for their account type. Other account service fees may apply as described in the Account Services Fee Schedule, which is also available at your local branch.

- Active qualifies as one or more transactions on a monthly basis.