This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

Save for a rainy day. Earn every day.

We make it easy for businesses to save with an account that earns interest on every dime, with no minimum. Let us help you get the basics covered so you can work with confidence.

- You own a business with basic savings needs.

- You move cash in and out of savings often.

- You want a long-term financial wellness plan.

Account Features

- 2 withdrawals free per month1

- Interest-earning account access

- $50 minimum required to open account

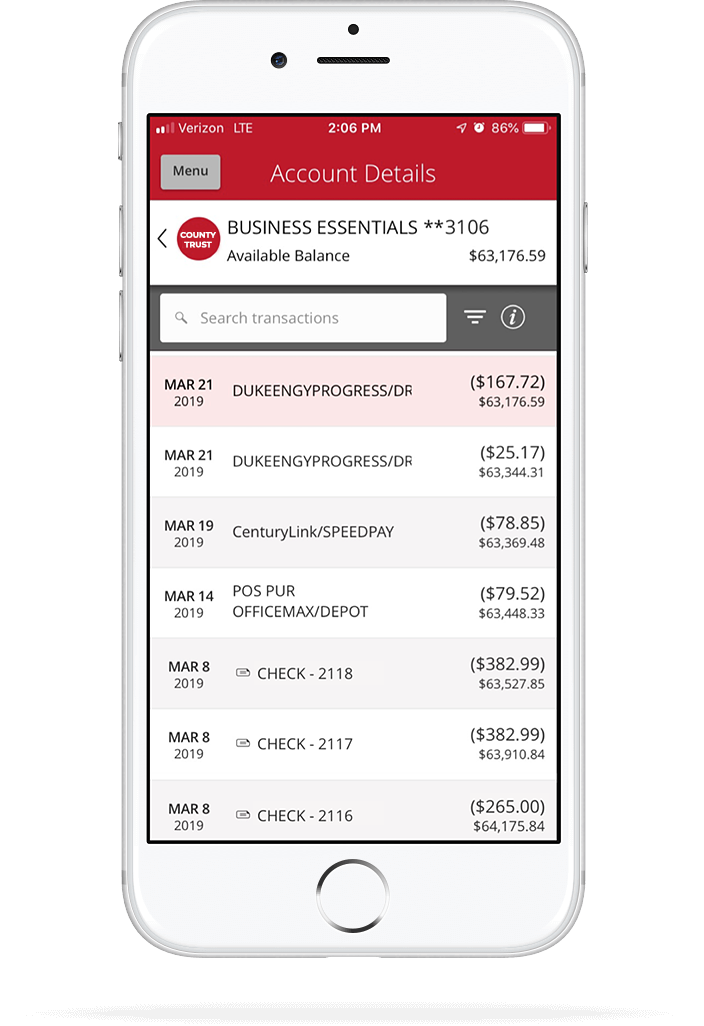

- Free digital banking2

- Free eStatements or paper statements

- Free direct deposit

Account Fees

You can easily avoid the $4 maintenance fee by meeting the following requirement during the statement cycle3:

- Maintain a $300 minimum daily balance

Account Benefits

Ready to get started?

You may be interested in…

- Savings account customers can make two (2) free withdrawals per month. There is a $2 fee for each additional withdrawal. Federal regulations limit withdrawals of preauthorized transfers to six (6) per month, including checks, drafts, online transfers, telephone transfers and debit card purchases. You may conduct an unlimited number of withdrawals at the ATM, in person at a branch, or by mail when the check is mailed to you.

- While Easthigh Credit Union does not charge for mobile banking, your mobile carrier’s message and data rates may apply.

- Account holders may avoid the Monthly Maintenance Fee by meeting any of the requirements listed in the Keep if Fee Free™ section of the account summary table for their account type. Other account service fees may apply as described in the Account Services Fee Schedule, which is also available at your local branch.